感谢Judy同学的分享!

Introduction

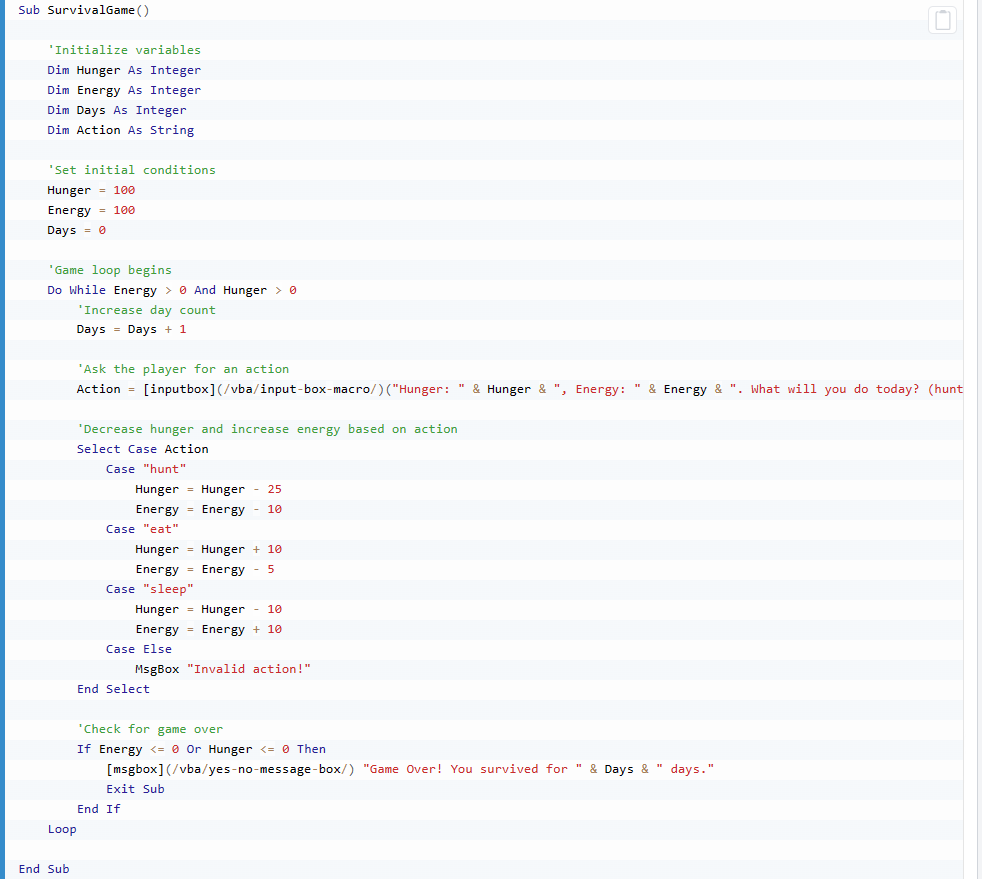

Experience Analysis is a method that many insurers and reinsurers will adopt to determine some rates based on experience, like mortality and claim utilization rates, which will be used by actuaries in valuation, pricing & so on.

For product like CI, can use EA to determine the incidence rate & improvement rate based on experience.

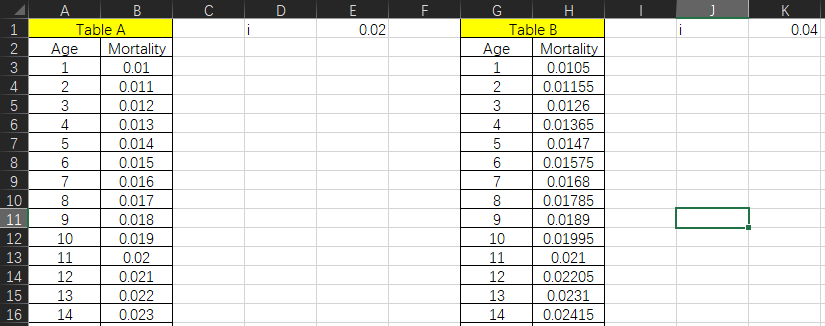

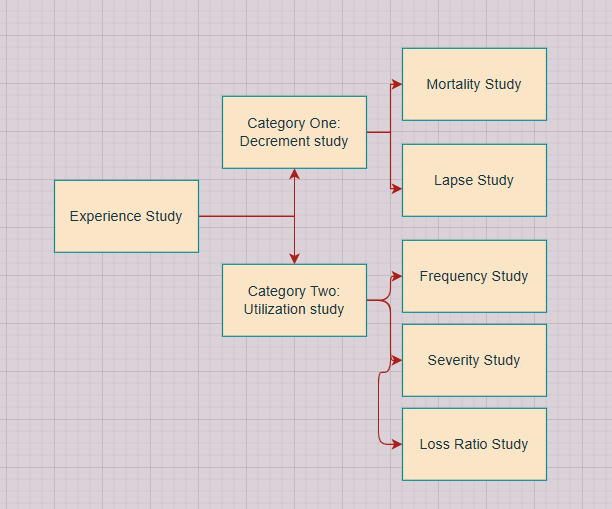

- There’re many different types of EA. Generally speaking, we can split EA studies into two categories by the event it studies:

- Category I mainly studies decrement which will lead lives leaving the population, including mortality study、lapse study、 A/E study and so on

- Category II mainly studies events that can occur while life is active in the population that do not result in the life leaving the population, like multiple claims for medical products. We call it a utilization study. Here we’ll do a frequency study, severity study, loss ratio study and so on.

Methodology

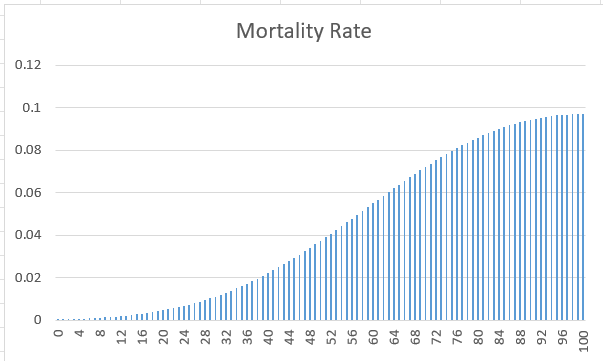

For the mortality study & lapse study in Category I, it’s easy to see that they both focus on decrement rate, but one is for mortality rate, the other one is for lapse rate. In fact, there are many different EA classified by product line and decrement type. Usually, this type of analysis will be carried out across the insurance industry to produce industry standard tables. While some insurance companies will also do this when their data is credible enough. The calculation logic is quite close: use the decrement amount counted at age x divided by the exposure amount at age x. For E.g. use dx/Ex to get the mortality rate. But there’s still a difference in the calculation of exposure amount. (This can be another question).

For A/E study, it’s usually used by companies with data only credible at the company level. By applying their A/E ratios to experience tables, a company can produce actual rates that match their overall experience. The A/E ratio at each age x is calculated by the actual death amount at age x: dx/ expected death amount at age x. The experience table could be industry-standard table or a standard table produced by the company itself.

For the Utilization study, it comprises the calculation of Frequency, Severity, Loss Ratio and so on in order to control rates of the event it observes. As for Medical products, there may be multiple claims for prescription drugs. In order to better estimate the expected claim amount, the company may use the historical data to do experience study, estimate: frequency rate over the year of age x: fx= nx( number of claims over age x)/Ex; severity rate over age x: Sx= Cx (total claim amount incurring at age x)/nx.

- After all, the scope of usage is of great importance when we try to apply A/E to do adjustments. Like for HKA18 REPORT ON HONG KONG ASSURED LIVES MORTALITY 2018 in Hong Kong, it’s produced based on data from fully underwritten, individual & duration >2 policies. So we need to do appropriate adjustments based on our requirements for valuation/pricing targets.

- Comparing with other products, EA for CI product is a little different. Besides calculating the incidence rate from experience, we also need to estimate the Cause Breakdown of CI product. Due to the Critical illness definitions are not standardized in Hong Kong, if we want to use industry table for pricing/valuation purposes, we need to do further adjustments.

NB:

- Death coverage & CI product both focus on incidence rate & improvement rate.

- CI types:

(1) standard CI: only cover claim for Critical illness

(2) accelerated CI: cover both CI claim & death claim – while CI occurs, will settle claims immediately. Later if occurs death, the settlement of claim will depend on whether the Max SA exceeds previous claim.

(3) additional CI: with 2 coverages: death & CI. Will pay claim separately once the 2 prescribed risk incidents occur.